Tax briefing – Spring 2021

Ideal salary for 2021-22 Fourth SEISS grant Free Covid-19 tests for employees IR35 – Off Payroll Working VAT debt paid in instalments Postpones Import VAT accounting For more information on the above and more please click this link for the HSA Newsletter – Spring 2021

Tax briefing – Budget 2021

Corporation tax complexity Super deduction for capital expenditure MTD – Points mean penalties Relief for business losses Frozen bands and allowances Two new SEISS Grants VAT boost for hospitality Stamp duty holiday extended Furlough scheme extended For more information on the above please click this link for the HSA Newsletter – Budget 2021

Tax briefing – Winter 2020

Third Self-Employed Income Support Scheme (SEISS.3) Report and pay Capital Gains Tax in 30 Days Furlough Extension Christmas Cheer for Employees Nudging to correct the tax return Deferring Tax due in 2021 VAT on low value imports VAT on International Services For information on these please click this link for the HSA Newsletter – Winter […]

Tax Briefing – Summer 2020

Self Employed Grants VAT Zero Rates Help with Statutory Sick Pay Grants from Local Authorities Working at Home Expenses CIS Repayments IR35 Rule Changes Deferred VAT and Bad Debt Relief For information on these and more please click this link for the HSA Newsletter – Summer 2020

Tax Briefing – Spring 2020

Surcharge on Home Purchases Help with Statutory Sick Pay NIC Allowance and Holiday Entrepreneurs’ Relief Capped Easing the Pension Charges Car and Van Benefits Relief from Business Rates Clarity on Life Assurance Gains New VAT Zero Rates Income Tax Rates and Allowances For information on these and more please click this link for the HSA […]

Tax Briefing – Autumn 2019

Trading and miscellaneous income Winding up the company Trivial benefits Planning to sell a home Construction Industry Reverse charge Avoid VAT registration Claiming cashback for R&D costs Off-payroll working How to avoid a VAT penalty For information on these and more please click this link for the HSA Newsletter – Autumn 2019

Tax Briefing – Summer 2019

Paying the right NIC Selling a let property Employee travel expenses Best start for new employees Healthy staff are happy staff Changes to IR35 Winding up a company How to split a business For information on these and more please click this link for the HSA Newsletter – Summer 2019

Tax Briefing – Spring 2019

Employee benefits VAT: Brexit realities MTD facts and fiction Pension health check New VAT rules for building firms Live-in workers Structures and buildings allowances For information on these and more please click this link for the HSA Newsletter – Spring 2019

Tax Briefing – Winter 2018

Gains from off-plan purchases Pension planning Making tax digital software Retain your entrepreneurs’ relief Termination payments Claw-back of child benefit Travel expenses fro self employed taxpayers Check your state pension forecast Interest from PPI claims Earlier year underpayments For information on these issues, please click this link to read the Winter 2018 edition of our […]

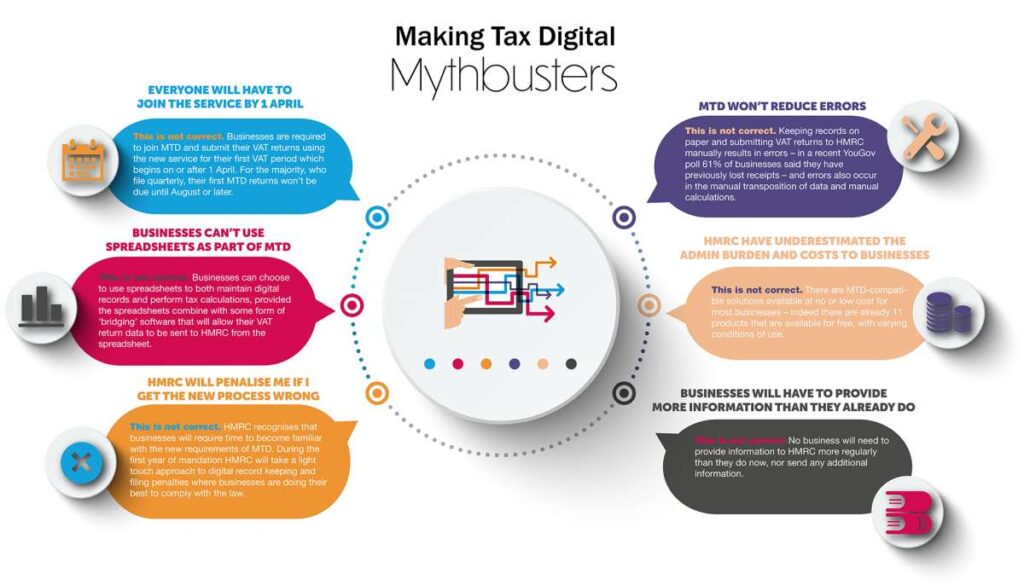

Making Tax Digital (MTD)

With Making Tax Digital for VAT around the corner we have decided to demystify some of the most common misconceptions surrounding MTD in the myth-buster infographic.

Tax briefing – Autumn Budget 2018

Entrepreneurs’ relief curtailed, Tax exemption for homes clipped, Tax cuts and cliff edges, Rollout of IR35 rules postponed, New capital allowances, Relief for first-time buyers, Business rates, Making tax digital and VAT, Tax Data 2019-20 For information on these issues and more, please click this link to read the Autumn 2018 edition of our quarterly […]

Tax briefing – Summer 2018

Childcare support, IR35, Electric vehicles, Late filing penalties, New rules for termination payments, Prepare to digitise VAT, For information on these issues and more, please click this link to read the Summer 2018 edition of our quarterly newsletter.

Tax briefing – Spring 2018

Paying your child from the business, National Minimum Wage and directors, Welsh land taxes, Rent a room relief, Annual tax on enveloped dwellings, Gifts liable to IHT, Avoid VAT penalties. For information on these issues and more, please click this link to read the Spring 2018 edition of our quarterly newsletter.

Tax briefing – Winter 2017

Simple Assessments, NIC for the self-employed, Property allowance, Money laundering regulations, Budget for your tax bills, Paying HMRC, State pension: when to stop, Making tax digital: VAT first. For information on these issues and more, please click this link to read the Winter 2017 edition of our quarterly newsletter.

Tax Briefing – Autumn 2017 Budget

Diesel bad, electric goodish, Who can claim the marriage allowance? VAT, MTD and fraud, Changes for companies, Stamp Duty Land Tax help for first-time buyers, Non-resident property owners Tax Date 2018-19 For information on these issues and more, please click this link to read the Autumn 2017 Budget edition of our quarterly newsletter.