CORONAVIRUS FINANCIAL SUPPORT

A range of business support measures have been made available to UK businesses and employees. This page helps businesses find out how to access the support that has been made available, who is eligible, when the schemes open and how to apply. Click Here

CORONAVIRUS (COVID-19) SELF-EMPLOYMENT INCOME SUPPORT SCHEME

Self-employment Income Support Scheme On Thursday 26 March the government announced their intention to provide further support for the self-employed in the form of a taxable cash grant. The scheme allows individuals to claim a taxable grant worth 80% of their trading profits up to a maximum of £2,500 per month for the 3 months […]

Corona Virus – Staffing

Due to the current situation regarding the Coronavirus Pandemic, we are limiting the amount of time our staff spend in the offices and with respect to the required social distancing request by the Government, we are aiming to ensure that no two members of our staff are in the office at the same time. We […]

Coronavirus Government Support

The Chancellor recently announced a massive bailout package to support small businesses and people during these unprecedented times. Everybody needs to keep their eyes and ears open as new announcements are being made virtually on a daily basis. The package of measures to support business include the following:- a Coronavirus Job Retention Scheme – all […]

March 2020 Payroll

Subject: March 2020 Payroll The following points are relevant to the payrolls of companies for March 2020. 1. Employers should pay employees whatever pay is due for the work done by employees up to the time they had to stop work because of the Coronavirus Pandemic. 2. Employers should identify names and dates of employees […]

Tax Briefing – Spring 2020

Surcharge on Home Purchases Help with Statutory Sick Pay NIC Allowance and Holiday Entrepreneurs’ Relief Capped Easing the Pension Charges Car and Van Benefits Relief from Business Rates Clarity on Life Assurance Gains New VAT Zero Rates Income Tax Rates and Allowances For information on these and more please click this link for the HSA […]

Tax Briefing – Autumn 2019

Trading and miscellaneous income Winding up the company Trivial benefits Planning to sell a home Construction Industry Reverse charge Avoid VAT registration Claiming cashback for R&D costs Off-payroll working How to avoid a VAT penalty For information on these and more please click this link for the HSA Newsletter – Autumn 2019

Tax Briefing – Summer 2019

Paying the right NIC Selling a let property Employee travel expenses Best start for new employees Healthy staff are happy staff Changes to IR35 Winding up a company How to split a business For information on these and more please click this link for the HSA Newsletter – Summer 2019

Tax Briefing – Spring 2019

Employee benefits VAT: Brexit realities MTD facts and fiction Pension health check New VAT rules for building firms Live-in workers Structures and buildings allowances For information on these and more please click this link for the HSA Newsletter – Spring 2019

Tax Briefing – Winter 2018

Gains from off-plan purchases Pension planning Making tax digital software Retain your entrepreneurs’ relief Termination payments Claw-back of child benefit Travel expenses fro self employed taxpayers Check your state pension forecast Interest from PPI claims Earlier year underpayments For information on these issues, please click this link to read the Winter 2018 edition of our […]

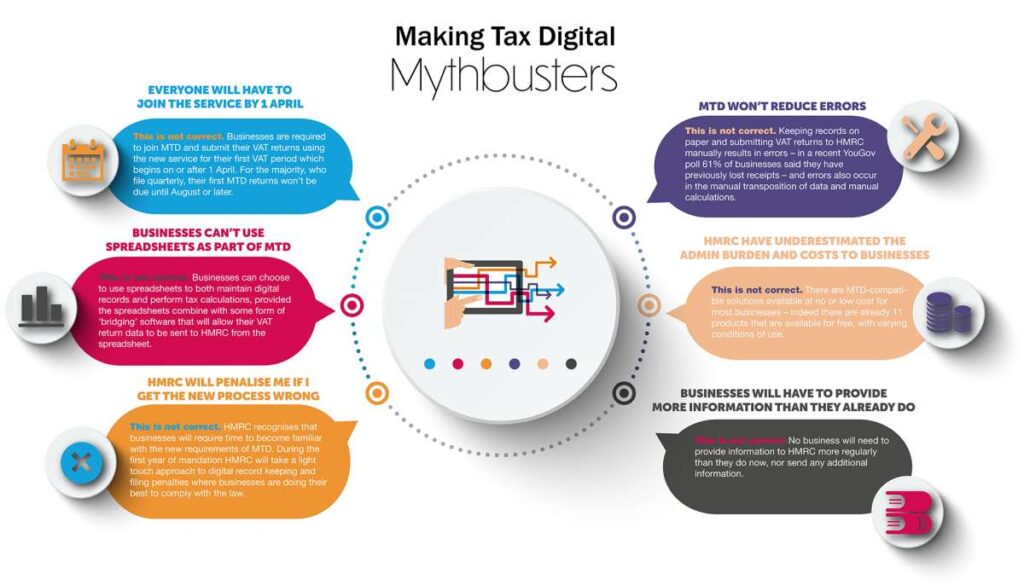

Making Tax Digital (MTD)

With Making Tax Digital for VAT around the corner we have decided to demystify some of the most common misconceptions surrounding MTD in the myth-buster infographic.

Tax briefing – Autumn Budget 2018

Entrepreneurs’ relief curtailed, Tax exemption for homes clipped, Tax cuts and cliff edges, Rollout of IR35 rules postponed, New capital allowances, Relief for first-time buyers, Business rates, Making tax digital and VAT, Tax Data 2019-20 For information on these issues and more, please click this link to read the Autumn 2018 edition of our quarterly […]

Tax briefing – Summer 2018

Childcare support, IR35, Electric vehicles, Late filing penalties, New rules for termination payments, Prepare to digitise VAT, For information on these issues and more, please click this link to read the Summer 2018 edition of our quarterly newsletter.

Tax briefing – Spring 2018

Paying your child from the business, National Minimum Wage and directors, Welsh land taxes, Rent a room relief, Annual tax on enveloped dwellings, Gifts liable to IHT, Avoid VAT penalties. For information on these issues and more, please click this link to read the Spring 2018 edition of our quarterly newsletter.

Tax briefing – Winter 2017

Simple Assessments, NIC for the self-employed, Property allowance, Money laundering regulations, Budget for your tax bills, Paying HMRC, State pension: when to stop, Making tax digital: VAT first. For information on these issues and more, please click this link to read the Winter 2017 edition of our quarterly newsletter.